Get Instant Loan Against Mutual Funds

Loan against securities (LAS) is a secured loan where you can avail of the loan by pledging your securities like mutual funds and shares as collateral. LAS is provided as an overdraft facility and is ideal for all your short to medium-term needs.

One of the main benefits of a digital loan against securities is that it allows borrowers to access cash without selling their investments. This means they can continue to earn returns on their securities while also using them to borrow money.

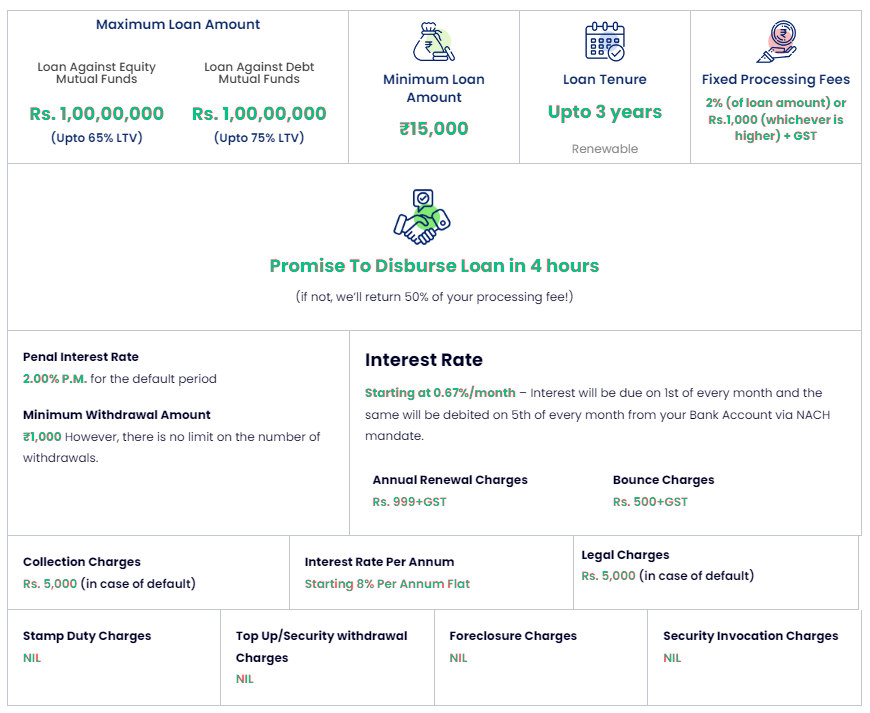

Loan Details & Charges

FAQs

A loan against mutual funds is a simple and convenient way to receive instant funds for any financial requirements. You just have to pledge your MF units as collateral and you’re good to go! This facility makes it easier for investors to meet their short-term needs. Instant loans against mutual funds are easily accessible both online and offline. The approval process is straight-forward & fast. Moreover, it comes with great benefits, such as lower interest rates, flexible repayment options.

With a loan against MFs, borrowers can get access to liquidity without selling their mutual funds and incurring losses due to market volatility. It also allows them to gain continual returns from their investments and keep their financial goals intact.

A loan against mutual funds online is a secured loan providing individuals with an option to borrow money without having to liquidate their investments. You can utilize this loan facility for a host of needs, such as setting up a business, dealing with an unexpected health crisis, bankrolling higher studies, adding capital assets, or more.

Obtaining an instant loan against mutual funds can be a great way to bypass selling your investments in a rush, minimize losses associated with market volatility, and avoid paying income gain tax. Whatever you may need the loan for, this is an incredibly advantageous option.

If you are looking to use your MFs as collateral for a loan, it’s important to be aware of the loan against mutual fund’s eligibility requirements. In order to obtain such a loan, you must be 18 years or older and possess investments in mutual funds. This is an easy way to get quick financing during times of financial distress.

A loan against mutual funds is a great option for investors looking to access quick capital. You can borrow money conveniently by pledging the MF units you have in your Demat account.

This loan facility offers you the opportunity to access liquidity without having to liquidate your investments. Also, it can provide a great help in relieving immediate financial pressure when necessary.

Applying for a loan against mutual funds online has its benefits – it offers quick approval and comes with flexible repayment options and lower interest rates compared to traditional loan products like personal loans or credit card loans. Besides, this loan does not require extra security or collateral, as your Mutual Funds serve as a guarantee for the creditor.

A loan on mutual funds is tailored for investors who are seeking solutions to their immediate cash needs. This product has been gaining immense popularity among customers for its convenience and ease of use. With this loan product, investors have an easy & convenient way to access 50-75% of their mutual fund’s value with minimal documentation and competitive interest rates. The loan value is determined by the market worth of the Mutual Fund units you provide as security. We offer 65% LTV on equity mutual funds and 75% LTV on debt mutual funds.

On an instant loan against mutual funds, the highest amount we offer is Rs. 1,00,00,000 based on the maximum credit limit of a lender. Similarly, a lender with minimum credit limit can borrow an amount as low as Rs. 15,000. Every lender has different minimum and maximum credit limits, which can differ from one another. We do not also check your credit history before sanctioning the loan.

Using your mutual funds as collateral is an effective way to borrow money against your MF units. Taking such a loan is a smart financial strategy. The amount you will get depends on the market value of mutual fund units offered as collateral. It can be an excellent way to obtain quick funds for various purposes.

The loan amount could range from 50-75% of the value of the mutual funds you pledge as security, varying from lender to lender. It is essential to assess the market worth of your mutual funds and evaluate the requirements set by the lender before applying for a loan against mutual funds.

Shivafinz provides you with a wide range of options when it comes to loan against mutual funds. Starting from ₹15,000, you can get up to ₹1 Crore, with flexible repayment terms. We offer a 65% Loan-to-Value ratio on equity mutual funds and 75% LTV on debt mutual funds.

Get Instant Loan Against Shares

Loan against equity shares is a secured loan option. It allows you to raise instant liquidity by pledging your shares. You can access cash quickly & easily by keeping our shares as collateral.

Once the loan is approved, funds are deposited directly in your linked bank account. You pay 10.5% p.a interest on the amount you have used and only for the days you use it. When surplus fund is available, you can also make prepayment towards the utilized amount without any prepayment charges.

While you pledge your shares for the overdraft limit, you still own the stocks keep enjoying all the ownership related benefits.

Currently, you can pledge shares held in a Demat account with NSDL only.

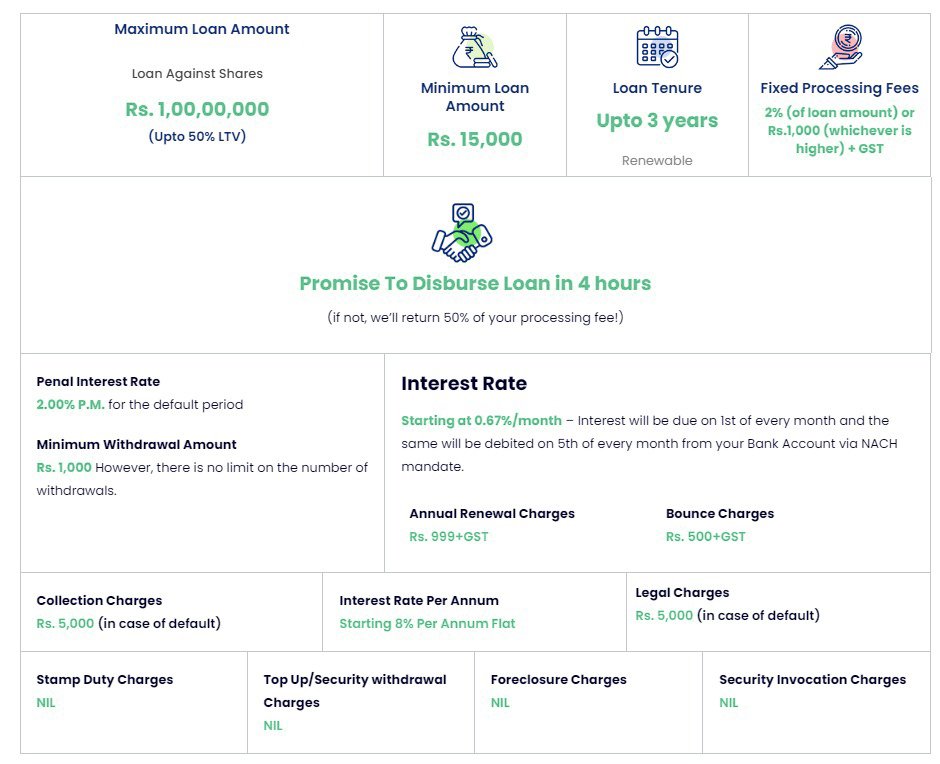

Loan Details & Charges

FAQs

A loan against shares online is a facility where you pledge your stock investments or equity shares as collateral in exchange for a loan. It is an instant source of funds to meet your immediate financial needs. Borrowers can avail of such a loan offline and online. In either case, the process for getting it approved is quite simple. The advantages of taking a loan against shares include low-interest rates, flexibility in repayment terms, and easy availability of funds.

A quick loan against shares provides liquidity to investors without having them sell their stocks and incur losses due to market fluctuations. It is an ideal solution for those who need funds but do not wish to compromise on the returns from their investments.

A loan against shares is a type of loan that allows individuals to use their shares as collateral to borrow money. Borrowers can use it for various purposes, including starting a business, financing an education, investing in capital assets, or more.

Irrespective of what you need it for, taking out an instant loan against shares saves you from selling your investments in haste, incurring unexpected losses due to market downfall, and paying income gain tax.

But if you want to borrow money against your shares, it is crucial to understand the loan against shares eligibility requirements. To be able to take a loan, you must be 18 or above with investments in the share/stock market. It is a way to access quick funds in times of financial need.

A loan against shares is one of the most convenient options available to stock market investors. It allows you to borrow money against your shares held in your Demat account.

This loan option provides access to liquidity without requiring you to sell off your investments. It also helps you manage any urgent financial needs.

The features of a quick loan against shares include flexible repayment options and lower interest rates than traditional loan products, such as personal loans or credit card loans. You can also enjoy tax benefits on the interest paid towards this loan..

Moreover, you don’t need additional security or collateral for this type of loan, as your shares act as collateral for the lender.

The loan amount depends on the market value of the shares you pledge as collateral. The minimum and maximum credit limits may vary from lender to lender. At Shivafinz, you can access a minimum loan amount of Rs. 15000. The maximum amount we offer on a loan against stocks is Rs. 1,00,00,000. We do not also check your credit history before sanctioning the loan.

Pledging your securities is an effective way to get quick funds when you need them most. An instant loan against shares allows you to borrow money against approved securities such as stocks, bonds, and mutual funds. The amount of funds you can get depends on a few factors, such as the type of security pledged and its current market value.

The loan amount could be 50-75% of the value of the securities you want to pledge as collateral. The percentage may also vary from lender to lender. It is crucial to evaluate the market value of your shares and other requirements set by the lender before applying for a loan against shares.

At Shivafinz, you can get flexible loan amounts on your securities, starting from Rs. 15000. The maximum amount you can get access to could be Rs. 1,00,00,000.

Get Instant Loan Against Bonds

If you have bonds that you do not want to sell, you can pledge to get a quick loan online to meet your financial emergencies. The loan facility, referred to as a loan against bonds allows you to access a flexible amount, ranging from Rs 15000 to Rs 1,00,00,000 at reasonable interest rates, arguably lower than an unsecured loan. Easy EMIs make the loan an easy go when repaying. The paperless digital process and quick disbursal within 4 hours make you wait no longer. A loan against bonds is a better way to safeguard your investment and deal with such demanding situations.

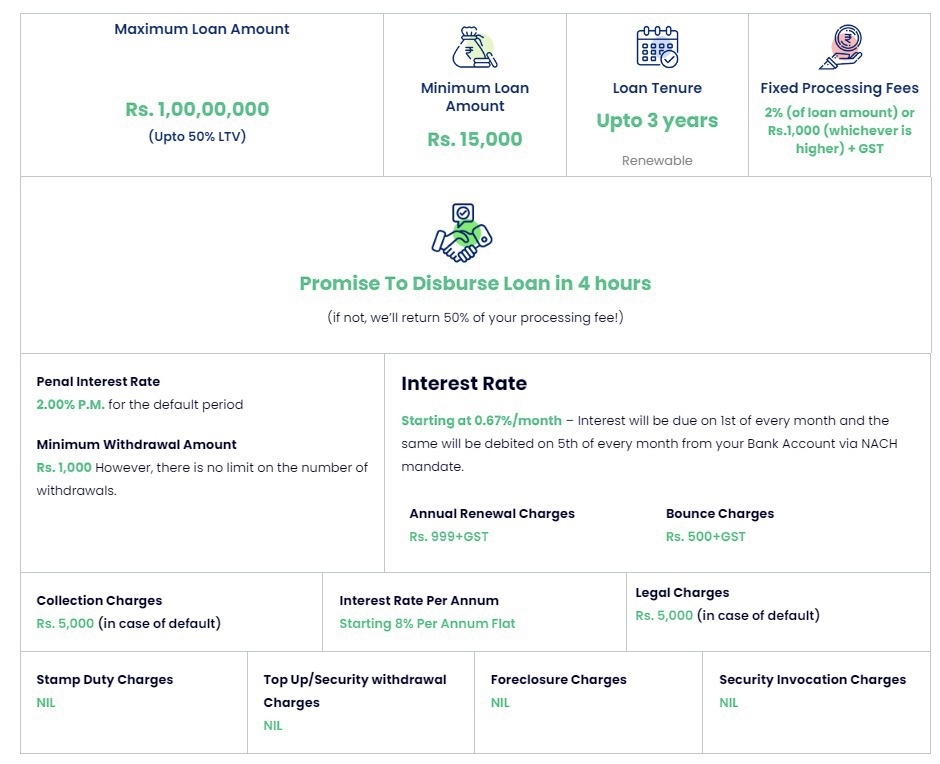

Loan Details & Charges

FAQs

A loan against Bonds is a simple and convenient way to receive instant funds for any financial requirements. You just have to pledge your Bonds as collateral and you’re good to go! This facility makes it easier for investors to meet their short-term needs. The approval process is straightforward & fast. Moreover, it comes with great benefits, such as lower interest rates, and flexible repayment options.

With a loan against Bonds, borrowers can get access to liquidity without selling their securities and incurring losses due to market volatility. It also allows them to gain continual returns from their investments and keep their financial goals intact.

A loan against Bonds is a secured loan providing individuals with an option to borrow money without having to liquidate their investments. Borrowers can use it for various purposes, including starting a business, financing an education, investing in capital assets, or more.

Irrespective of what you need it for, taking out an instant loan against Bonds saves you from selling your investments in haste, incurring unexpected losses due to market downfall, and paying income gain tax.

If you want to use your Bonds as collateral, it is important to understand the eligibility first. In order to obtain such a loan, you must be 18 years or older and possess investments in Bonds. This is an easy way to get quick financing during times of financial distress.

A loan against Bonds is a great option for investors looking to access quick capital. You can borrow money conveniently by pledging the Bonds you have in your Demat account.

This loan option provides access to liquidity without requiring you to sell off your investments. It also helps you manage any urgent financial needs.

Applying for Loan against Bonds comes with its own benefits like flexible repayment options and lower interest rates in comparison to other traditional loan products. Moreover, borrowers can also enjoy tax benefits on the interest paid towards this loan.

When applying for Loan against Bonds, the loan amount will vary depending upon the type of security pledged. However, we provide loans starting from the range of as low as Rs 15,000. The maximum amount we offer on an instant loan against bonds is Rs. 1,00,00,000. We also do not check your credit history before sanctioning the loan.

Pledging your securities is an effective way to get quick funds when you need them most. The amount of funds you can get depends on a few factors, such as the type of security pledged and its current market value.

The loan amount could be 65% of the value of the securities you want to pledge as collateral. The percentage may also vary from lender to lender. It is crucial to evaluate the market value of your securities and other requirements set by the lender before applying for a loan against Bonds.